reports data management

The Worldwide Cloud Based Data Management Services Industry is Expected to Reach $141.2 Billion by 2027

The Worldwide Cloud Based Data Management Services Industry is Expected to Reach $141.2 Billion by 2027

GlobeNewswire

GlobeNewswire

Published on : Dec 6, 2022

The "Cloud Based Data Management Services Market by Service Type (Integration, Security & Back-up, Quality), Service Model (SaaS, PaaS, IaaS), Deployment Mode (Public, Private), Vertical, Region - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

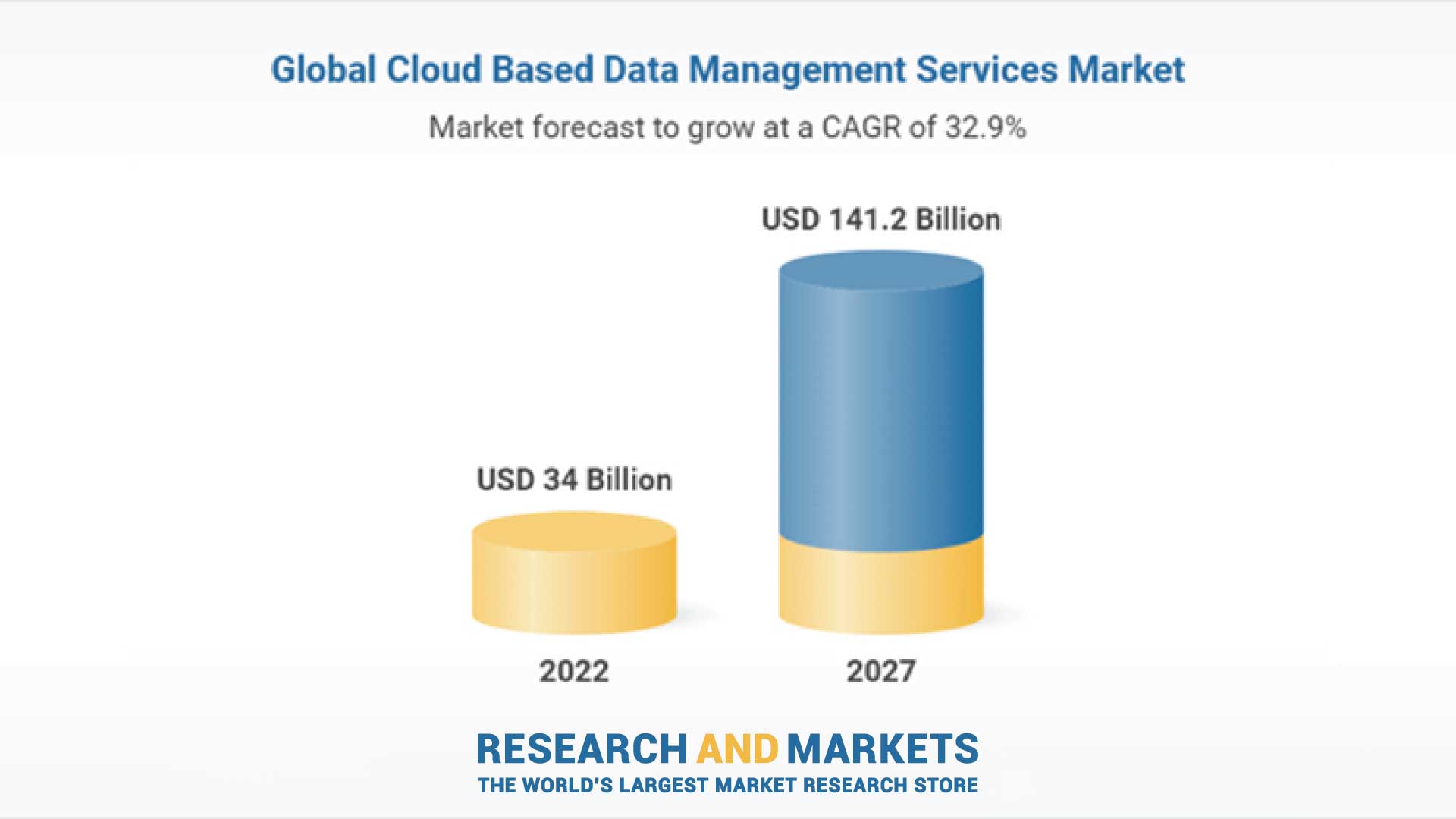

The Cloud Based Data Management Services market size is expected to grow from USD 34.0 billion in 2022 to USD 141.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 32.9% during the forecast period.

| Report Attribute | Details |

| No. of Pages | 225 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value (USD) in 2022 | $34 Billion |

| Forecasted Market Value (USD) by 2027 | $141.2 Billion |

| Compound Annual Growth Rate | 32.9% |

| Regions Covered | Global |

Software-as-a-Service segment to account for a larger market size during the forecast period.

Organizations need better ways to manage and protect their data, as well as gain new insights. The SaaS data management models offer back-up & recovery, disaster recovery, archiving, file & object services, dev/test provisioning, and data governance and security through a single vendor. This model eliminates the need to work with multiple providers and solutions for SaaS-based data management.

The idea of applying a SaaS model to what has traditionally been an IT-managed function would seem to offer several advantages, including reducing the burden IT faces in managing data infrastructure, bringing more cost predictability to the equation, scaling on demand, giving midsize companies tools to compete more effectively against larger enterprises, and accessing cloud based apps and services to derive additional value from data.

BFSI industry vertical to hold largest market share in 2022

Banking, financial services, and insurance (BFSI) have to rapidly digitalize to meet the changing customer needs. Data has become an integral part of businesses- from acquiring customers to serving them, personalization to predictive analytics; businesses are increasingly becoming data-driven businesses. Further, touchless digital banking and app-based transactions have gained much traction.

To operate efficiently with much agility, financial services companies are migrating to the cloud. Moreover, traditional banks will be able to embrace digital banking at a much faster pace in a cloud environment and come up with innovative products that will effectively compete with modern fintech firms in the marketplace.

With data integration, banks learn more about their customers' needs, wants, and expectations, which allows banks to boost sales. Cloud Based data management services offer a 360-degree view of a customer who can quickly identify any illegal financial activities such as money laundering, tax evasion, or fraud, as well as other major crimes such as terrorism activity, allowing the financial institution to take timely action.

North America to hold largest market share of Cloud Based Data Management Services market in 2022

North America comprises major economies that drive investments in R&D activities and develop new technologies related to the cloud based data management services market. Further, the increase in the number of small businesses in the region indicates sustainable growth. In 2022, the number of small businesses in the US has reached 33.2 million, which forms around 99% of the US business sector. This is likely to boost the demand for cloud Based data management services market across North America.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Overview of Cloud Based Data Management Services Market

4.2 Market, by Service Type, 2022 vs. 2027

4.3 Market, by Service Model, 2022 vs. 2027

4.4 Market, by Deployment Mode, 2022 vs. 2027

4.5 Market, by Vertical, 2022 vs. 2027

4.6 Market: Regional Scenario, 2022-2027

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Enhanced Elasticity and Efficiency

5.2.1.2 Increased Demand for Improved Data Usability and Quality

5.2.1.3 Speed of Implementation and Deployment

5.2.1.4 Demand for Workplace Collaboration

5.2.1.5 Simplified Data Backup and Disaster Recovery

5.2.2 Restraints

5.2.2.1 Performance Issues

5.2.2.2 Lack of Appropriate Infrastructure in Emerging Economies

5.2.3 Opportunities

5.2.3.1 Growing Demand for Cloud Based Master Data Management (MDM)

5.2.3.2 Advisory and Consultancy Services

5.2.4 Challenges

5.2.4.1 Assertion of Privacy and Security

5.2.4.2 Business Benefits and Reliability

5.2.4.3 High Cost of Storing Data on Cloud

5.3 Case Study Analysis

5.3.1 Case Study 1: Predictx Empowered Insights with Avalanche Cloud Data Platform

5.3.2 Case Study 2: Netapp Helped Karcher Switch to Cloud and Enhance Innovation

5.3.3 Case Study 3: Boomi Helped Rivus Fleet Solutions Streamline Internal Data Communications

5.4 Pricing Analysis

5.5 Value Chain Analysis

5.6 Impact of COVID-19 on Market Dynamics

5.7 Porter's Five Forces Analysis

5.8 Patent Analysis

6 Cloud Based Data Management Services Market, by Service Type

6.1 Introduction

6.1.1 Market, by Service Type: Drivers

6.1.2 COVID-19 Impact on Market, by Service Type

6.2 Integration Services

6.2.1 Need to Streamline Data Flow Across Networks

6.3 Data Security & Back-Up Services

6.3.1 Demand for Data Governance Driven by Increasing Volume of Enterprise Data

6.4 Quality-As-A-Service

6.4.1 High Cost of Processing Unstructured Data Formats

7 Cloud Based Data Management Services Market, by Service Model

7.1 Introduction

7.1.1 Market, by Service Model: Drivers

7.1.2 COVID-19 Impact on Market, by Service Model

7.2 Software-As-A-Service

7.2.1 Eliminates Need to Work with Multiple Providers and Solutions

7.3 Platform-As-A-Service

7.3.1 Flexible Data Management with No Significant Upfront Costs

7.4 Infrastructure-As-A-Service

7.4.1 Supports Use Cases of All Types

8 Cloud Based Data Management Services Market, by Deployment Mode

8.1 Introduction

8.1.1 Market, by Deployment Mode: Drivers

8.1.2 COVID-19 Impact on Market, by Deployment Mode

8.2 Public Cloud

8.2.1 Low Capital Expenditure to Deploy Data Management Solutions

8.3 Private Cloud

8.3.1 Offers Highly Secure and Centralized Storage Infrastructure

8.4 Other Deployment Modes

9 Cloud Based Data Management Services Market, by Vertical

9.1 Introduction

9.1.1 Market, by Vertical: Drivers

9.1.2 COVID-19 Impact on Market, by Vertical

9.2 Banking, Financial Services, and Insurance (bfsi)

9.2.1 Rising Need for Digital Transformation and Improved Customer Experience

9.3 IT & Telecom

9.3.1 Demand for Technological Innovation to Provide Personalized Services

9.4 Retail & Consumer Goods

9.4.1 Need to Optimize Supply Chains and Make Informed Business Decisions

9.5 Government & Public Sector

9.5.1 Rising Requirement for Transformation of Public Sector Data Management Infrastructure

9.6 Energy & Utilities

9.6.1 Demand for Real-Time Big Data and Analytics to Manage Data Sources

9.7 Manufacturing

9.7.1 Demand for Integrated Database Management

9.8 Healthcare & Life Sciences

9.8.1 Need to Collect and Manage Growing Size of Patient Data

9.9 Education

9.9.1 Need to Integrate Data from Disparate Systems

9.10 Media & Entertainment

9.10.1 Need to Reduce Operating Costs to Remain Competitive

9.11 Research & Consulting Services

9.11.1 Helps in Offering Infrastructure to Support Data Management

9.12 Other Verticals

10 Cloud Based Data Management Services Market, by Region

11 Competitive Landscape

11.1 Overview

11.2 Market Evaluation Framework

11.3 Strategies Adopted by Key Players

11.4 Revenue Analysis

11.5 Market Share Analysis

11.6 Company Evaluation Quadrant

11.6.1 Stars

11.6.2 Emerging Leaders

11.6.3 Pervasive Players

11.6.4 Participants

11.6.5 Company Product Footprint Analysis

11.7 Ranking of Key Players

11.8 Competitive Scenario and Trends

11.8.1 Deals

11.8.2 Others

12 Company Profiles

12.1 Key Players

12.1.1 IBM

12.1.2 Fujitsu

12.1.3 Cisco

12.1.4 Dell Technologies

12.1.5 HPE

12.1.6 Netapp

12.1.7 Informatica

12.1.8 SAS

12.1.9 Actian

12.1.10 Oracle

12.2 Other Key Players

12.2.1 SAP

12.2.2 AWS

12.2.3 Accenture

12.2.4 Snowflake

12.2.5 Talend

12.2.6 Hitachi Vantara

12.2.7 Cloudera

12.2.8 Teradata

12.2.9 Experian

12.2.10 Alibaba Cloud

12.2.11 Tibco Software

12.2.12 Cohesity

13 Adjacent Market

14 Appendix