apps for business

Digital Cross-Border Net Terms Now Empowers B2B Transactions

Digital Cross-Border Net Terms Now Empowers B2B Transactions

GlobeNewswire

GlobeNewswire

Published on : Oct 13, 2022

Seamless Net Terms and Trade Credit Invoicing Without Risk or Hassle Are Now Available to B2B Merchants Worldwide

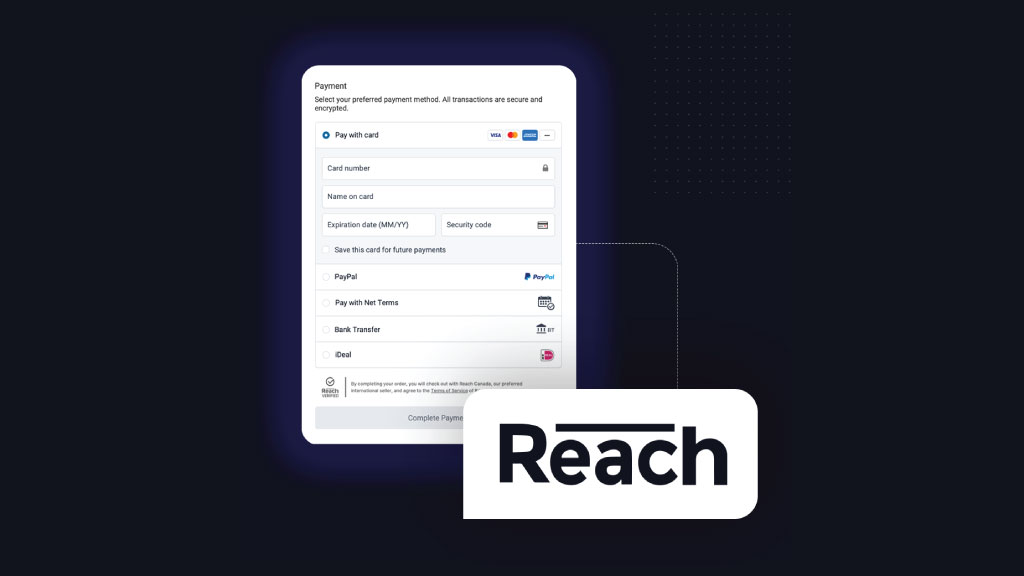

Reach, the global leader in cross-border e-commerce payments, is pleased to announce that its payments system now enables net terms of up to 60 days for business-to-business transactions. The need to modernize cross-border B2B payments has become a prominent point of conversation for international businesses as legacy payment methods continue to create friction and lag their payment process. With Reach's net terms offering, international companies can remove these pain points with one out-of-the-box solution for B2B payments.

Reach's Merchant of Record model eliminates the fragmented nature of traditional net terms payments by engaging its global network to manage FX, regional requirements, and compliance all through one platform. Traditionally, international businesses have struggled to offer net terms due to cash flow restrictions, FX management requirements, and the administrative burdens needed to gain approval from cross-border lenders. Reach has optimized this payment process by leveraging its sophisticated Merchant of Record model and dynamic platform.

Offering net terms through Reach empowers international businesses to drastically reduce their DSO and allows them to get paid in real-time. Additionally, Reach takes on 100% of the liability of the net terms transaction, whether the buyer pays or not. This ability means the seller experiences the expedited cross-border cash flow, without the associated risk.