reports financial technology

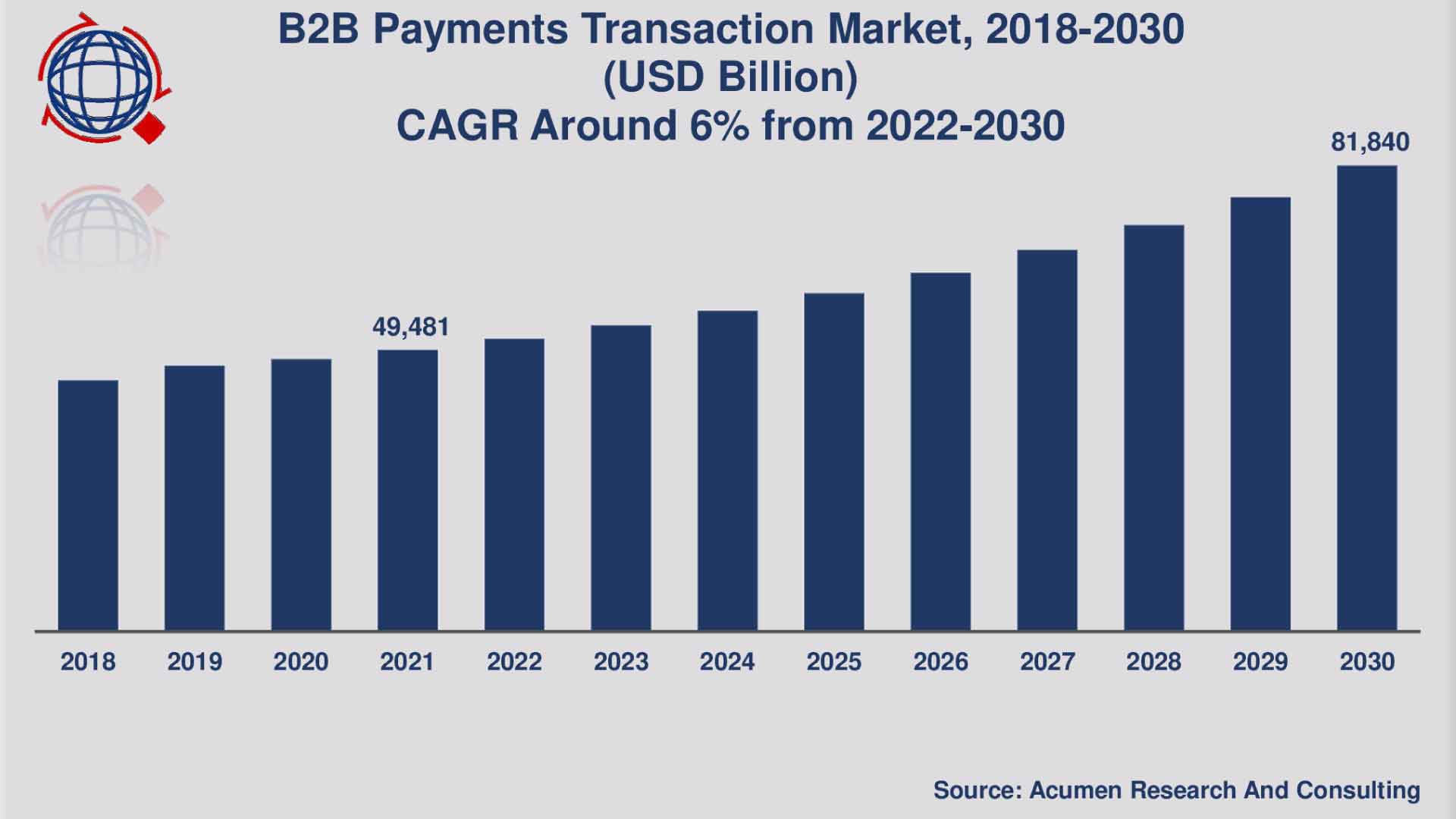

B2B Payment Transaction Market Size Will Attain USD 81,840 Billion by 2030 growing at 6% CAGR - Exclusive Report by Acumen Research and Consulting

B2B Payment Transaction Market Size Will Attain USD 81,840 Billion by 2030 growing at 6% CAGR - Exclusive Report by Acumen Research and Consulting

GlobeNewswire

GlobeNewswire

Published on : Nov 9, 2022

Acumen Research and Consulting recently published report titled “B2B Payment Transaction Market Analysis Report and Region Forecast, 2022 - 2030”

The Global B2B Payments Transaction Market Size accounted for USD 49,481 Billion in 2021 and is projected to achieve a market size of USD 81,840 Billion by 2030 rising at a CAGR of 6% from 2022 to 2030.

B2B Payment Transaction Market Statistics

- Global B2B payment transaction market value was USD 49,481 Billion in 2021 and expected to grow at CAGR of 6% from 2022 to 2030

- North America B2B payment transaction market revenue over 40% market share in 2021

- As per recent figures, it has been projected that the total volume of annual B2B payments is approximately USD 120 trillion per year

- Asia-Pacific B2B payment transaction market growth will record noteworthy CAGR of over 7% from 2022 to 2030

- Among payment type, domestic payments sub-segment gathered more than 64% of the overall market share in 2021

- Based on payment mode, wrinkle removal generated around 65% of the total market share

- Surging mergers between B2B payment players and FinTech giants is a global B2B payment transaction market trend fueling the industry demand

B2B Payment Transaction Market Growth Factors

- Surging expansion of trades throughout the world

- Rising number of online payment activities

- Increasing import and export of goods & services

- Mounting penetration of smartphones

Request For Free Sample Report @ https://www.

B2B Payment Transaction Market Report Coverage:

| Market | B2B Payment Transaction Market | |

| B2B Payment Transaction Market Size 2021 | USD 49,481 Billion | |

| B2B Payment Transaction Market Forecast 2030 | USD 81,840 Billion | |

| B2B Payment Transaction Market CAGR During 2022 - 2030 | 6% | |

| B2B Payment Transaction Market Analysis Period | 2018 - 2030 | |

| B2B Payment Transaction Market Base Year | 2021 | |

| B2B Payment Transaction Market Forecast Data | 2022 - 2030 | |

| Segments Covered | By Payment Type, By Enterprise Size, Payment Mode, By Industry Vertical, And By Geography | |

| B2B Payment Transaction Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa | |

| Key Companies Profiled | American Express Co. Inc., Ant Financial Services Co. Ltd., Bottomline Technologies Inc., Coupa Software Inc., FleetCor Technologies Inc., Intuit Inc., JPMorgan Chase & Co., MasterCard Inc., PayPal Holdings Inc., SAP, TransferWise Ltd., and Visa Inc. | |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis | |

B2B Payment Transaction Market Dynamics

Payments made between two merchants for goods or rather services are known as B2B payments. Paper checks are still the most common method of payment for businesses. A digital B2B payment solution is a quick payment method that includes issuing, receiving, and processing systems, all of which can improve a company's cash flow. Business to business transactions, such as the purchase of parts and goods for use in manufacturing procedures, are common in the typical supply chain. People can be marketed finished products through transactions between the consumer and the business.

The gradual increase in income, as well as the increase in consumer spending on goods and services, is expected to bolster market growth. Governments in developed and developing countries are focusing on the development of payment infrastructure to facilitate the digital economy approach, as well as the introduction of various applications, all of which are factors strongly impacting the global B2B payment industry growth. The Indian Banks Association launched the Unified Payments Interface (UPI) in 2016, and the National Payments Corporation of India (NPCI) created the Bharat Interface for Money (BHIM) app. UPI manages multiple bank accounts through a single mobile app from any participating bank.

Furthermore, factors such as high internet penetration and increasing smart phone adoption are gradually increasing consumers' preference for mobile payments via various applications, which is expected to support market growth. In 2016, the BHIM app processed approximately 16.5 million UPI transactions totaling INR 68,872.57 crore. The interface processed 93,000 transactions totaling $30 million for 21 banks.

However, rising threats/activities related to data theft, as well as a lack of a regulatory scenario for overseas payments, are factors impeding market growth. Hackers with easy access to high-speed internet can easily track and steal data. Two billion data records were compromised in 2017, according to the World Economic Forum, and more than 4.5 billion records were violated in the first half of 2018. Furthermore, limited visibility of end-to-end transaction due to multiple payments, incorporation of extra costs, chargebacks, and payment cycle disruption are causing a preference for B2B payment methods to be less preferred. Another factor that is expected to limit market growth is a lack of transaction transparency.

Government spending on cyber security is high, and factors such as developing government regulations linked to cyber crime and improved infrastructure are creating revenues and profits for target market players. Furthermore, with the introduction of new technologies such as big data analytics, AI, and blockchain, entrepreneurs are expected to simplify the B2B payment system, further supporting market revenue growth.

Check the detailed table of contents of the report @

https://www.

B2B Payment Transaction Market Segmentation

The global B2B payment transaction market is divided into five categories: payment type, enterprise size, payment mode, industry vertical, and region. The payment type segment is categorized into domestic payments and cross-border payments. The global B2B payment transaction market is divided into enterprise size such as large enterprise and small and medium sized enterprises. The payment mode is classified into digital and traditional. Industry vertical segment is categorized into BFSI, IT & telecom, manufacturing, energy & utilities, metals & mining, and others. Furthermore, North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa are the regional classification.

B2B Payment Transaction Market Share

The domestic payments sub-segment generated the most revenue in 2021, and it is anticipated that this trend will continue from 2022 to 2030, according to the B2B payments transaction industry report.

According to the market forecast for B2B payments transactions, the large companies sub-segment held more than half of the market shares from 2022 to 2030. Due to the government of developing nations' approach to digitalization, the digital section of transaction type is gaining ground. Between 2022 and 2030, BFSI dominated the majority of the market share based on the industrial vertical segment.

B2B Payment Transaction Market Regional Growth

Due to the substantial consumer spending capacity on food and entertainment services, as well as the availability of cutting-edge internet infrastructure for smart payment choices, the North American market will account for a large revenue share in 2021. Additionally, the presence of significant service providers operating in the nation, such as the US and Canada, is anticipated to boost the expansion of the regional market.

Buy this premium research report –

https://www.

B2B Payment Transaction Market Players

American Express Co. Inc., Bottomline Technologies Inc., Ant Financial Services Co. Ltd., JPMorgan Chase & Co., Coupa Software Inc., Intuit Inc., FleetCor Technologies Inc., MasterCard Inc., and SAP are significant companies in the global b2b payment transaction market. Due to the large number of competitors present in the industry, the competitive environment is intense. The competition is predicted to grow as a result of major competitors' propensity to grow their customer bases and enhance the consumer experience.

Questions Answered By This Report

- What was the market size of B2B Payment Transaction Market in 2021?

- What will be the CAGR of B2B Payment Transaction Market during the forecast period from 2022 to 2030?

- Who are the major players in Global B2B Payment Transaction Market?

- Which region held the largest share in B2B Payment Transaction Market in 2021?

- What are the key market drivers of B2B Payment Transaction Market?

- Who is the largest end user B2B Payment Transaction Market?

- What will be the B2B Payment Transaction Market value in 2030?

Browse More Research Topic on Payment and Transaction Related:

The Global Payment Security Market accounted for USD 18.3 Billion in 2020 with a considerable CAGR of 15.7% during the forecast period of 2021 to 2028.

The Global Payment Gateway Market Size accounted for USD 26.8 Billion in 2021 and is estimated to achieve a market size of USD 106.4 Billion by 2030 growing at a CAGR of 16.8% from 2022 to 2030.

The Global P2P Payment Market Size accounted for USD 1,872 Billion in 2021 and is estimated to achieve a market size of USD 9,135 Billion by 2030 growing at a CAGR of 19.7% from 2022 to 2030.